Let me first point out that professional athletes are in the news much more than your average American. Therefore, we hear more about athletes squandering away their wealth than we do the average American. The book “Rich Dad Poor Dad” by Robert Kiyosaki does a good job portraying why the average American squanders away their wealth over a lifetime, but why do professional athletes consistently run out of money soon after they retire?

I like to compare professional athletes with lottery winners. Sudden wealth is something that needs significant attention and long term planning. We are all guilty of this on a smaller scale. Personally, I received a sum of money after graduating from college, but instead of saving the money or investing in appreciating assets, I spent it on traveling and nightlife. The major difference between our pro athlete and the lottery winner is the time leading up to the wealth. A lottery winner is not prepared for the sudden wealth, so I can understand that it can be easily mismanaged. A “top prospect” pro athlete has no excuses. The athlete knows he/she is going to receive life changing amounts of money and has to educate themselves on basic financial management and have unbiased financial advice.

Why do the people that pro athletes trust so often end up being the wrong people? How can the people that surround these athletes allow them to fail financially? These are two questions I will uncover by using examples from current events.

According to the infamous Sports Illustrated story, How (and Why) Athletes Go Broke, from 2009 by Pablo S. Torre, when it comes to hiring a business manager or advisor, Magic Johnson was quoted as saying “they [professional athletes] hire these people not because of expertise but because they’re friends. Well, They’ll fail.” It is common for a young athlete to entrust someone close to them, and history has shown that this has been a major contributor to their financial failure. Finding the right person to “trust” with their financial matters should be one of the top priorities by athletes and their families.

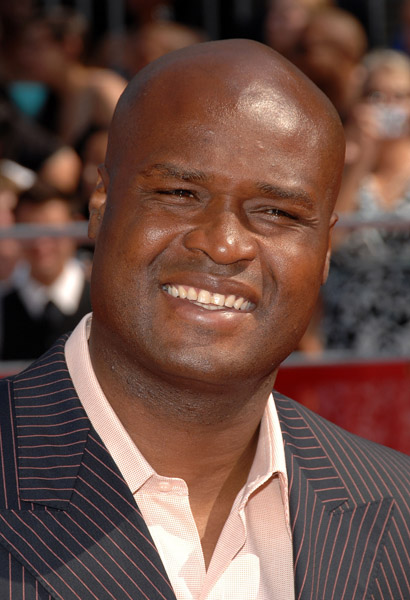

On March 22, 2010, there was a story involving ProStyle Financial, who was investing their clients' money with Scott D. Farah and his failed Meredith mortgage company. The pro athletes included recent super bowl champion, Bobby McCray Jr., and current Dallas Cowboy Jeremiah “Jay” Ratliff. This is an example of why it is so important for athletes to become educated on the process of due diligence. Young athletes and their families need to start seeking out financial education at an earlier age. This may sound like we are putting the cart before the horse, but if the athlete does not make it to the professional level, no harm has been done. They will be better educated in financial matters for the rest of their life. However, if they do make it to the next level, they will be better prepared to recognize and handle the financial situations that will arise.

When choosing a trusted advisor, there are a few things to have at minimum, including answers to these questions:

- What are their qualifications? The NFL Players Association does a great job of answering this question for their athletes. They conduct background checks and make sure the advisor is in good standing with all of their licenses, including the advisor's civil, criminal and regulatory history.

- What services the advisor offers, what they sell, and do they work with a team? There is a lot that goes on behind the scenes as far as advisor compensation. It is important for the athlete to know of any potential conflicts of interest of the advisor giving advice and selling a particular product.

- What kind of experience do they have and do they have a specialty? Always ask about the advisor's education, as well as experience dealing with people whose financial lives are similar to yours.

- What is the advisors approach to financial planning? Does the advisor specialize in giving investment advice only? Does he/she invest aggressively or cautiously and do they offer advice on a variety of subjects like taxes, insurance, and real estate purchases?

Why do the people that surround these athletes allow them to fail? The answer to that is the people surrounding these athletes often time lead to their failure.

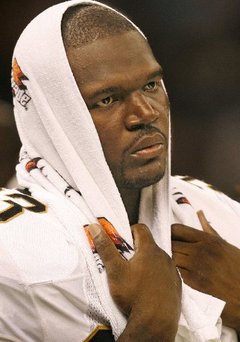

According to the recent article by Mark Shwarz of ESPN Million Dollar Mistakes, Antoine Walker like many athletes was foolish with his robust income. "When I was younger I used to travel with probably eight or nine guys, which is a very expensive lifestyle to live because you are traveling the world. That's eight, nine rooms. That's eight, nine flights," Walker explained in the interview. He went on to talk about lending money to friends and entrusting friends as business partners. It has been published time after time that these so called “business associates” have caused the financial ruin of countless young athletes. There are many psychological factors that come into play because of their relationships with family and friends. Being able to say “NO” is a skill that athletes must learn. This very behavior is glorified in the hit show “Entourage” on HBO by the character Turtle, a minimally qualified "assistant" reaping the rewards of his wealthy childhood friend. Fortunately, for athletes, every mistake that I have researched has been avoidable through education and sound advice.

According to the recent article by Mark Shwarz of ESPN Million Dollar Mistakes, Antoine Walker like many athletes was foolish with his robust income. "When I was younger I used to travel with probably eight or nine guys, which is a very expensive lifestyle to live because you are traveling the world. That's eight, nine rooms. That's eight, nine flights," Walker explained in the interview. He went on to talk about lending money to friends and entrusting friends as business partners. It has been published time after time that these so called “business associates” have caused the financial ruin of countless young athletes. There are many psychological factors that come into play because of their relationships with family and friends. Being able to say “NO” is a skill that athletes must learn. This very behavior is glorified in the hit show “Entourage” on HBO by the character Turtle, a minimally qualified "assistant" reaping the rewards of his wealthy childhood friend. Fortunately, for athletes, every mistake that I have researched has been avoidable through education and sound advice.

In my opinion, the main reason pro athletes go broke is because of the lack of education. If there is one thing I leave you with here it is to focus on education. If you look at the psychological factors of acquiring significant amounts of money, it is not a surprise that so many pro athletes end up losing everything. This is why it is important if you are a parent, friend, advisor, etc. to educate not only the athlete, but also yourselves on financial matters before it is too late.

The reason I entered into the business of financial advice is to help others understand the basic fundamentals of our complex financial world. The reason I joined forces with Rock Mirich, an Investment Advisor Representative at Avant-Garde Advisors, LLC, is that I get to combine my passion for helping clients with financial issues and sports. There are many extra issues when dealing with pro athletes, including multiple state income tax returns, business expenses, early age retirement, and high divorce rates, just to name a few. To help the athletes, we must continue to educate them with common sense, logical reasoning, and current events outlining mistakes by their fellow brethren and how they are avoidable. Please follow my monthly column Here We Go Again, as I document the successes and failures of professional athletes in the financial arena.

If you have any suggestions for my column or stories involving athletes and finance that you would like to share, you can email me at trevorbmason@gmail.com.

Gregg Swanson

05-04-2010Great info Trevor! I strongly believe as you do, that the athletes should start out early understanding finances. Actually ALL people should start out early even if they aren’t going to be an athlete. If you can’t handle the small things you’ll never be able to handle the large things. Start handling the finance now, before you don’t have any finances to manage.

Comments Closed

Sergio Quintana

05-05-2010Great blog! One thing I would like to comment on is the mindset of these individuals, athlete or not, when they employ their unqualified friends to help with their finances. Coming from a disadvantaged neighborhood, and knowing someone who became a professional athlete, I have observed this phenomenon first hand. When these individuals receive such large amounts of money at one time it is their natural reaction to splurge with family and friends. As you stated, we are all guilty of doing it but on a much smaller scale. Even now if I have a friend who is always looking out for me when I need something, I would look out for them as well if I became wealthy. The difference with me is I would seek professional advice from a reliable source so I could set my friends up to make their own money.

Comments Closed

Joseph Bua

05-19-2010I'm glad you are shedding some more light on this subject. As you mentioned, it is a struggle that is illustrated all too often on many fronts, not just in the sports realm. The parallels you speak of between lottery winners and (some) athletes are spot on, and unfortunate in so many ways.

When speaking of athletes, it is imperative to mention the role of their agents and how influenced athletes are of them. It is the agent's responsibility to look out for their client on all fronts, not just during free agency. I will go as far as saying that agent's hold some of the blame for this phenomenon. But how much? It is easy to point fingers, but how many superstar athletes want to be told what classes to take and what to do with their money? Many agents might be reluctant to force that on a client because there are hundreds of others who would be glad to ignore the facts and shower them with what they want to hear.

It all comes down to education, and I think you are exactly right. As a tutor of financial coursework, I understand the importance of knowledge and preparation. Every time I tutor a student athlete, I can only hope that I can get through to them beyond the scope of their next exam. Preparation should start the moment you become aware, but when you become aware is completely up to you. Some people never do.

Comments Closed